Prudence Concept in Accounting

Read this article to learn about the principles of accounting. The concept of the accounting period is an important one for financial statements.

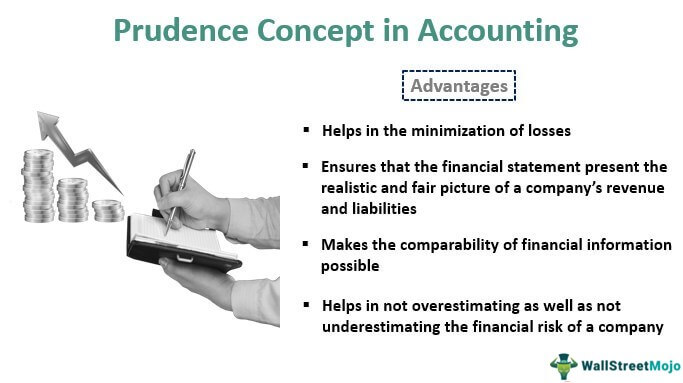

Prudence Concept In Accounting Advantages And Disadvantages

If a financial result can be reported in two ways the least beneficial way is used.

. According to this principle business is treated as an entity which is separate and distinct from its owners. The concept advises that the final accounts of a company must always show caution while reporting any figures specifically impacting the income and expenses. In particular is considered wise to book an income only when it is realized.

It is classically considered to be a virtue and in particular one of the four Cardinal virtues which are with the three theological virtues part of the seven virtues. Outline the distinguishing features of various types of business organizations. State the purpose of accounting.

Further as a matter of prudence all other NBFCs are also encouraged to adopt these guidelines on liquidity risk management on voluntary basis. However losses even those not realized but with the remote possibility of occurring should be included in the financial statements. Double -entry book keeping principles including the maintenance of accounting records a Identify and explain the function of the main data sources in an accounting systemK.

CXC 10GSYLL 06 6. Financial information might be of material importance to one company but stand immaterial to another company. Prudentia is an allegorical female personification of the.

Keeping this in view. IFRS Edition 3 ed 1119372933 9781119372936. Conservatism also called prudence.

The IASB indicates that neutrality is supported by prudence. Expenses and liabilities are not understated in. The concept of materiality in accounting is subjective relative to size and importance.

Identify the users of accounting information. Under the concept cameral accounting. And matching concept prudence conservatism concept consistency concept separate entity concept.

International Financial Reporting Standards do allow. So all losses are recognized those that have occurred or are even likely to occur. That is the.

Explain the concept of accounting. Alongside this expenses should be booked as soon as a reasonable. It is further assumed that business has its own identity distinct from the owners creditors debtors managers and others.

This accounting concept promotes prudence in accounting. An organization should use the. The basic simple variant of cameral accounting.

The materiality concept of accounting stats that all material items must be properly reported in financial statementsAn item is considered material if its inclusion or omission significantly impacts the decision of the users of financial statements. Eg the Prudence concept Prudence Concept Prudence Concept or Conservatism principle is a key accounting principle that makes sure that assets and income are not overstated and provision is made for all known expenses and losses whether the amount is known for certain or just an estimation ie. It means that for the purposes of accounting the business and its owners are to be treated as two separate entities.

Accounting conceptsK Materiality ii Substance over form iii Going concern v Accruals vi Prudence Consistency C The use of double-entry and accounting systems 1. The guidelines deal with following aspects of Liquidity Risk Management framework. Prudentia contracted from providentia meaning seeing ahead sagacity is the ability to govern and discipline oneself by the use of reason.

The internal controls required to be put in place by NBFCs as per these guidelines shall be subject to supervisory review. Prudence is the exercise of caution when making judgments under conditions of uncertainty. It states that profit should not be included until it is realized.

Which is the materiality concept sensibly applied. Prudence concept is a very fundamental concept of accounting that increases the trustworthiness of the figures that are reported in the financial statements of a business. 221 Business Entity Concept The concept of business entity assumes that business has a distinct and separate entity from its owners.

This aspect of the materiality concept is more noticeable when comparing companies that vary in size ie a large company vis-à-vis a small company. An accounting period is the interval of time during which accounting activities are measured. Generally Accepted Accounting Principles incorporate the prudence concept in many accounting standards which for example require you to write down fixed assets when their fair values fall below their book values but which do not allow you to write up fixed assets when the reverse occurs.

Accounting Entity Separate Entity Concept. The prudence principle of accounting also known as the conservatism principle states that a business should exercise a good degree of caution when booking incomes and expenses. Fundamental QualityFaithful Representation.

One example of this kind of prudence and historical cost valuation in government accounting is the. The items that have very little or no impact on a users decision are termed as immaterial or insignificant items.

Prudence Concept In Accounting Overview Guide

Prudence Concept Ceopedia Management Online

No comments for "Prudence Concept in Accounting"

Post a Comment